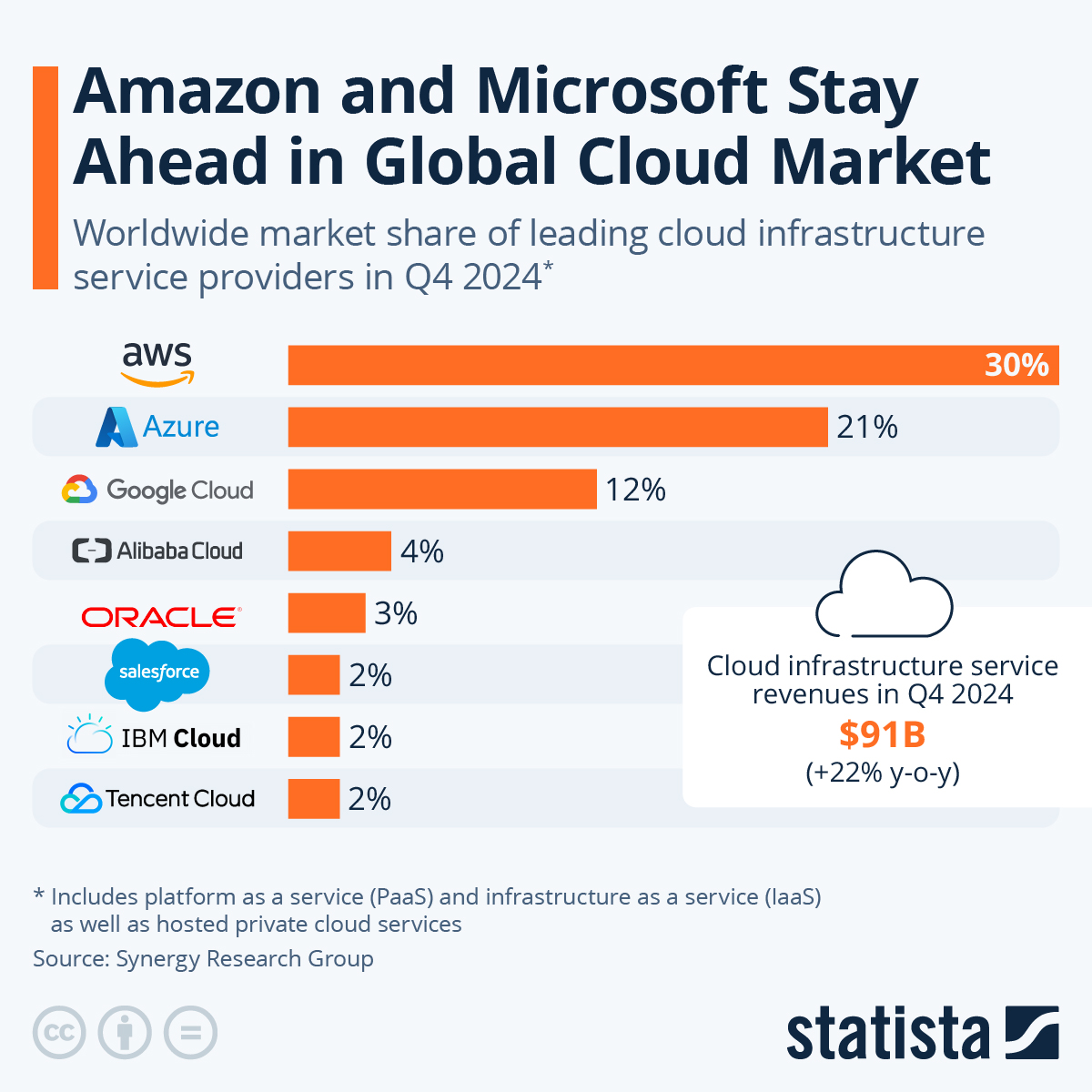

After having established itself as an early leader in the market for cloud infrastructure, AWS is still ahead of the pack. According to estimates from Synergy Research Group, Amazon’s market share in the worldwide cloud infrastructure market amounted to 28 percent in the fourth quarter of 2025, ahead of Microsoft's Azure platform at 21 percent and Google Cloud at 14 percent. Together, the "Big Three" hyperscalers account for more than 60 percent of the ever-growing cloud market, with the rest of the competition stuck in the low single digits. For Amazon, AWS has been a key driver of profitability and the perfect addition to its low-margin core retail business. In 2025, Amazon's cloud business accounted for 18 percent of the company's total sales but for 57 percent of its operating profit. At almost $130 billion in annual revenue and $45 billion in operating profit, AWS is a key and sometimes overlooked component of Amazon's success.

In Q4 2025, global cloud infrastructure service spending grew $29 billion or 30 percent compared to the same period of 2024, bringing total spending to $119 billion for the three months ended December 31. Looking at the full year 2025, cloud infrastructure service revenues exceeded $400 billion for the first time, explaining why the market is so fiercely contested. Despite its size, the cloud market is still growing strongly, with year-over-year growth accelerating each of the past nine quarters. Thanks to the AI boom and the computing requirements that come with it last quarter's growth rate was the highest in more than three years.

"We said that Q3 market numbers were very impressive, but they pale by comparison with Q4. Growth rates like these have not been seen since early 2022, when the market was less than half the size it is today,” John Dinsdale, chief analyst at Synergy Research Group said.