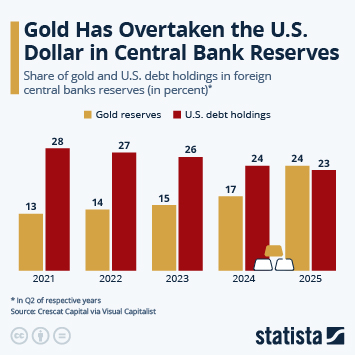

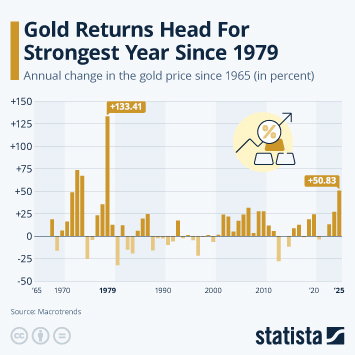

In a world marked by economic crisis, geopolitical tensions and inflation, national gold reserves play a crucial role: they bolster currency credibility, shield against market volatility and serve as a guarantee in times of crisis. In recent years, as uncertainty lingers, central banks around the world continued to stockpile this precious metal, making gold a key geoeconomic indicator.

The United States is by far the country holding the largest gold reserves, with over 8,100 tons in June 2025, according to data compiled by The World Gold Council. This stockpile, primarily stored at Fort Knox, represents nearly 75 percent of the U.S. foreign exchange reserves, and reflects a long-term strategy to uphold confidence in the dollar. Germany (3,350 tons) and Italy (2,452 tons) round out the podium, while France (2,437 tons) and Russia (2,330 tons) remain major global actors.

While the U.S. and Europe generally maintain historical stockpiles, Asia is where the most dynamic growth is occurring. China has considerably expanded its gold reserves since 2020, adding around 350 tons in just five years. With a stockpile reaching approximately 2,300 tons in June 2025 - the sixth largest worldwide - Beijing has significantly reduced its reliance on the dollar and is aiming to strengthen the yuan's role on the global stage. India, the world's second-largest gold consumer after China, is following a similar trajectory. Between 2020 and 2025, the Reserve Bank of India increased its reserves by over 200 tons, bringing its total to nearly 900 tons (the eighth largest ahead of Japan). New Delhi is betting on gold to stabilize the rupee amid global economic uncertainty.