Cost of living in the U.S.- statistics & facts

U.S. consumers

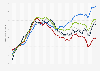

Like much of the world, the United States experienced high levels of inflation in 2022, and U.S. residents saw essential goods and services become much more expensive. Monthly inflation peaked at 9.1 percent in June 2022, with annual inflation reaching a multi-decade high of eight percent. Inflation fell throughout 2023 and 2024, reaching 2.4 percent in September 2024. As of September 2022, 34 percent of U.S. consumers indicated that they were struggling to make ends meet. Furthermore, the Consumer Sentiment Index reached 79 in January 2024, following a year of overall growth. Despite the rising cost of goods, consumer spending remained steadyat almost six percent in 2023. Consumers had more money in the pockets than usual to spend as shops re-opened and social distancing rules were relaxed. Spending on entertainment and apparel grew by around five percent when compared with 2022.Calculating the cost of living

The traditional method for quantifying living costs involves aggregating the prices of certain basic goods and services. These prices are then compiled into indices than can be used to compare the change in costs over a certain time period or across different locations. The Consumer Price Index (CPI) is one of the most commonly used indices to track price changes of consumer goods over time. The CPI for all urban consumers in the U.S. has seen year on year growth almost every year for the last three decades, growing the most dramatically between 2020 and 2023.While CPI is a useful tool for tracking price changes for a collection of goods over time, different goods are impacted by inflation at different rates. For example, in 2022 the price of eggs increased by nearly 60 percent from the previous year, and the cost of electricity 15.6 percent over the same period. Despite the tightening economic conditions seen across the U.S., wages have not kept up with inflation and many Americans cannot afford to purchase the same goods and services they were once accustomed to.

Housing

Housing is one of the most important and necessary monthly expenditures for residents of any country. In the U.S., just over 65 percent of Americans own their home. This is a rate that has recovered slightly from the 2008 financial crisis, before which nearly 70 percent of Americans owned their home. Average house prices of new homes sold in the U.S. have skyrocketed over the last decades with preliminary data for 2023 showing the average sale price of a new home was 511,100 U.S. dollars.With many people priced out of home-ownership opportunities, the number of renters in the U.S. has also increased. Despite the fact that renting is a greater monthly expense than a mortgage payment in many states, the soaring rates of down payments has many unable to pay large sums of money upfront, especially for Millennials who have been held back both by student loan debt, and recent dramatic increases in monthly rent. Americans looking for a studio apartment can expect to spend more than one thousand U.S. dollars per month on average, making it even more difficult to put money aside to save for eventual homeownership.

Cost of living in different states

As a country covering 9.8 million kilometers, there are significant cost of living disparities seen across different states and geographic areas. In both Maryland and Washington D.C., the median household income in 2023 exceeded 105,000 dollars. Families in these states can also expect to pay some of the highest rates for housing or services such as child-care. At the other end of the spectrum, households in Louisiana and Mississippi saw median household incomes closer to the 50,000-dollar mark. Accordingly, Mississippi had one of the lowest cost of living index score in the United States at 86.3.Hawaii is located nearly 5,000 miles away from the continental United States had the highest cost-of-living index score of any state. In 2021, Hawaiian residents paid around 44.14 U.S. cents per kilowatt-hour. The second most expensive state for electricity was California, whose electricity price came to 34.31 U.S. cents per kilowatt-hour in comparison. Overall, Hawaiian residents pay significantly more for monthly residential utility costs than residents of any other state.