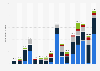

Large companies making billions and billions of dollars in revenue are designed to earn their investors and stakeholders fortunes. Unless—they just don’t? What sounds counterintuitive is not uncommon. The reasons for why large companies that are losing money are kept alive vary, however, as seen in an analysis of enterprises with more than $12 billion in revenue which were included on the Forbes Global 2000 list of the world’s biggest companies.

According to the latest annual data as of April 2022, several of last year’s biggest losers are in an ongoing struggle due to the coronavirus pandemic. This includes Air France-KLM Group, which lost $3.9 billion in one year, the equivalent of 23 percent of its annual revenue of almost $17 billion. Another case is East Japan Railway, incurring 19 percent of its revenue as a loss. Cruise lines were even harder hit, sustaining several times their annual revenues in losses, but are not included in the chart because of their smaller overall revenues of $1.5 billion (Royal Caribbean Group) and $3.5 billion (Carnival Corporation).

An even more interesting case of corporate money pits are tech enterprises. These are usually handed wads of fresh capital from investors who are betting big on these innovative companies becoming (very) profitable down the line. In a global comparison, Chinese tech giants had the biggest holes in their pockets. Video sharing platform Kuaishou experienced a loss almost equal to its $12.6 billion revenue last year. Ride hailing giant Didi as well as delivery venture Meituan could also not turn a profit despite having become fixtures of urban life in the country. The Chinese government’s crackdown on tech has been an additional setback for internet companies.

A third category of businesses losing big are legacy companies. French IT firm Atos, Texas-based Cheniere Energy or Gruppo Tim, formerly Telecom Italia, were affected last year. For them, the reasons for giant losses are more company-specific. Atos cited an unexpected higher cost tied to a U.K. outsourcing contract, project “slippages” and customer and payment postponements as reasons for their ginormous loss. Gruppo Tim said it struggled with impairment of domestic goodwill as well as a large write-off of deferred tax assets. Finally, Cheniere Energy lost a fortune despite its business in the liquefied natural gas segment booming last year. According to industry sources, the company sells its liquefied gas at fixed prices but is subject to price fluctuations on the natural gas it buys and processes. When prices for the fossil fuel surged majorly in 2021, the company started to burn money instead of gas.