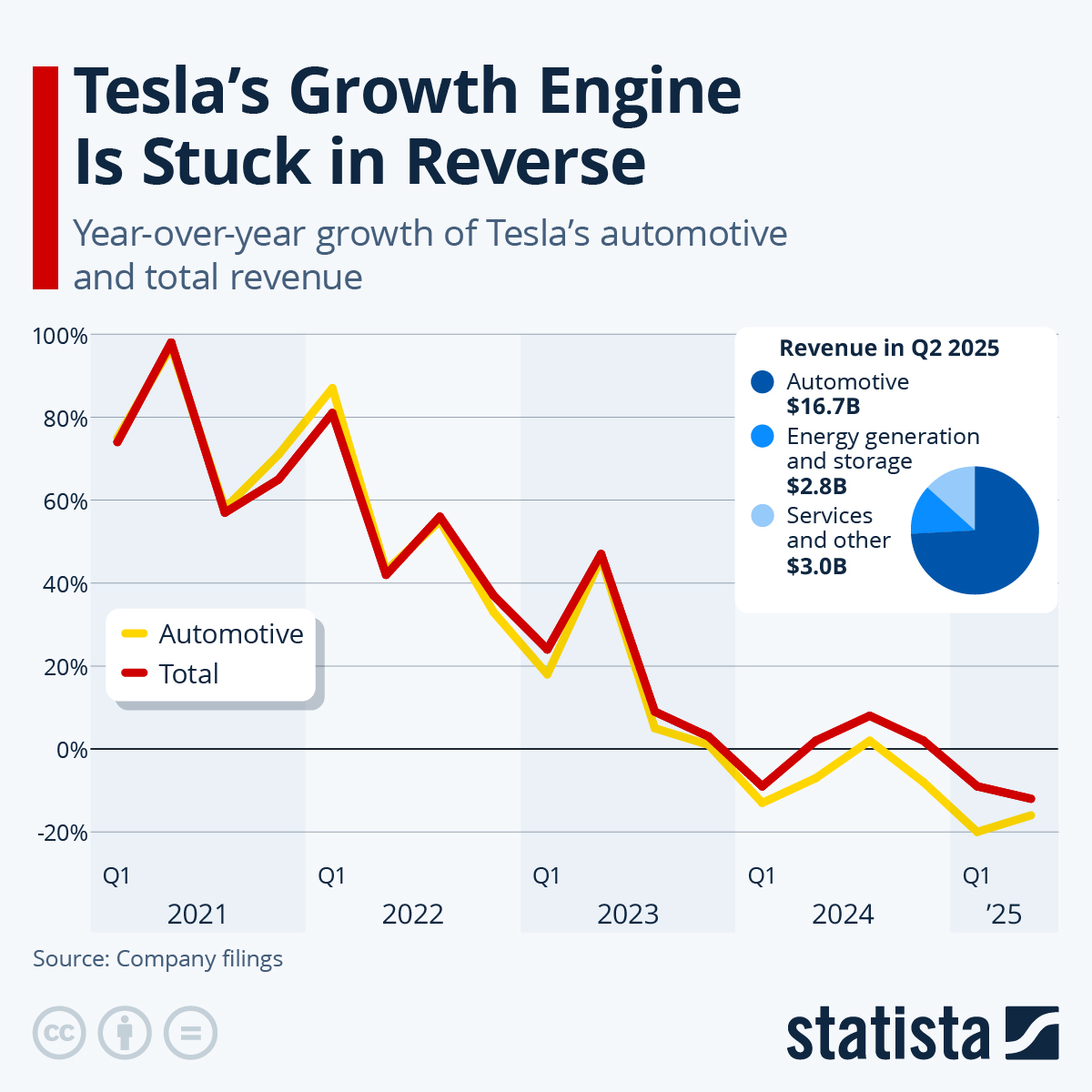

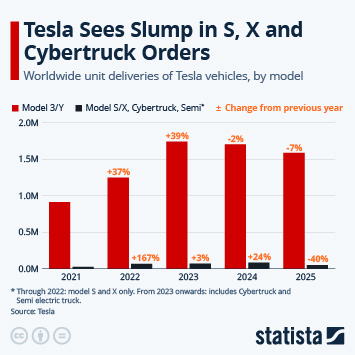

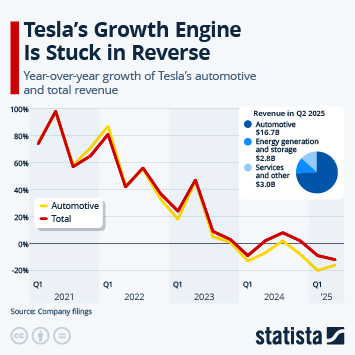

On Wednesday, Tesla reported second quarter earnings that missed expectations on both the top and bottom line. Revenue dropped 12 percent to $22.50 billion versus expectations of $22.64 billion, while operating profit of $923 million fell almost 25 percent short of Wall Street’s consensus forecast. In line with the largest ever decline in vehicle deliveries the company reported three weeks ago, Tesla’s automotive revenue, which accounts for roughly three quarters of the EV maker’s total revenue, declined 16 percent, continuing a worrisome trend of underperformance in its core business.

Not only are Tesla’s vehicle sales slumping – particularly in Europe, where Tesla sales have fallen of a cliff this year – but the company’s sales of regulatory credits to competitors are about to dry up. For years, other automakers purchased credits from Tesla to keep selling combustion-engine cars and still meet emissions targets, a practice that has netted the company a windfall of $10.6 billion since 2019. The Trump administration’s One Big Beautiful Bill Act removes those penalties for legacy carmakers, creating a sizeable hole in Tesla’s top and bottom line.

In the second quarter of 2025, regulatory credit sales dropped 50 percent year-over-year and that’s just the beginning. Analysts expect Tesla’s revenue from these credits to drop 75 percent next year and disappear completely by 2027, wiping out $2 to $3 billion in annual revenue and an important contributor to the company’s profit. Add to that the fact that Trump’s spending bill also abolishes the $7,500 tax credit for EV buyers and Tesla’s growth engine could be stuck in reverse for a while.