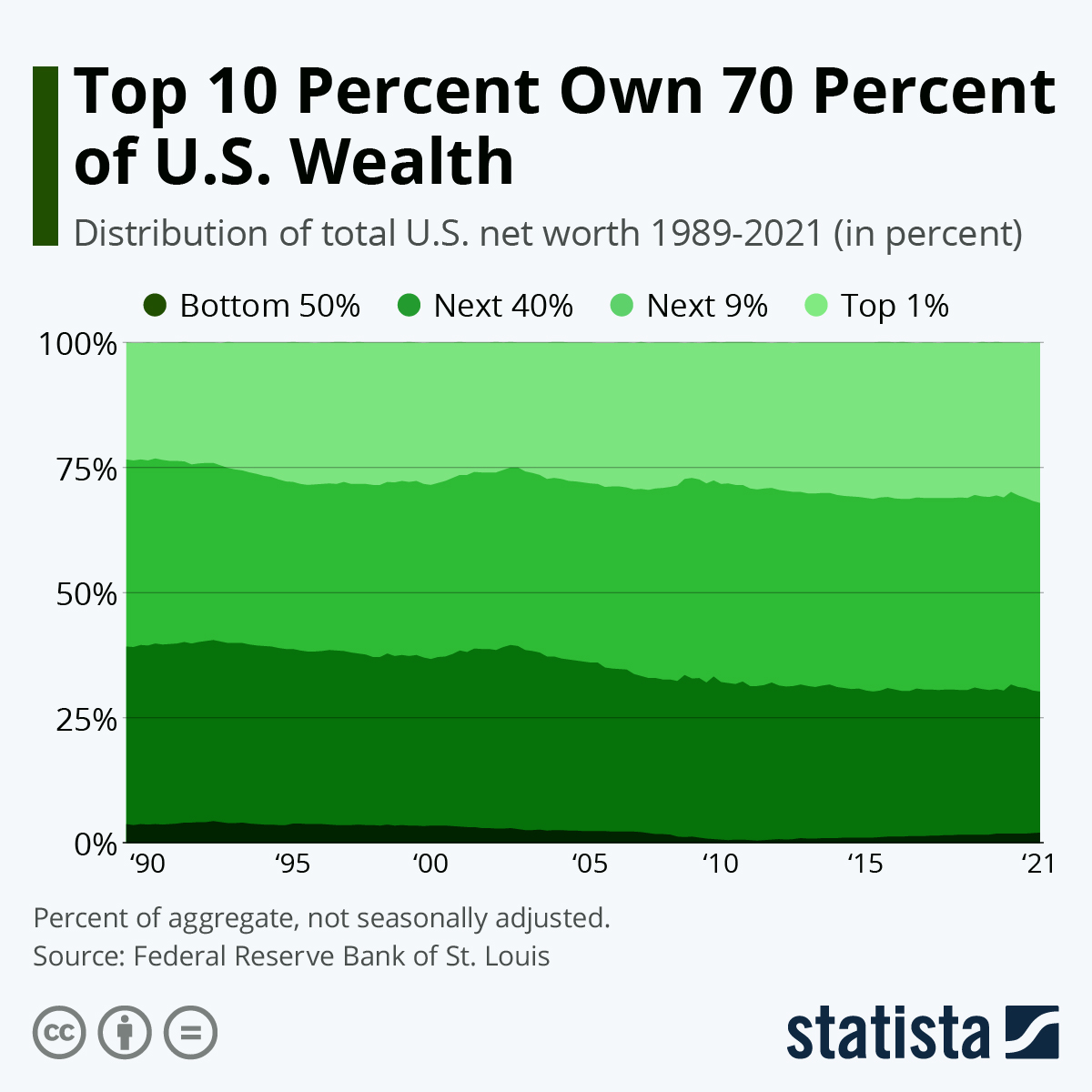

The share of wealth owned by the 1 percent of richest people in the United States has reached a new record of 31.7 percent in the third quarter of 2025, the highest since records began in 1989, according to figures published in late January by the Federal Reserve.

Q2 of 2025 and Q4 of 2024 had already seen new all-time highs set at or above 31 percent, as the wealth of the super-rich tends to recover quicker from setbacks like financial crises and global upheaval. Billionaire wealth around the world also reached a new record last year, accelerating its growth over previous years, according to recent calculations by Oxfam. The nonprofit cites tax breaks for the wealthy and unchecked monopoly power as reasons for this development.

The net worth of the top 1 percent in the U.S. has been above a share of 30 percent almost consistently since 2014, while the top 10 percent currently own just over 68 percent of the country’s wealth. This is in stark contrast to just 2.5 percent of U.S. net worth in the hands of the 50 percent at the bottom of the wealth ladder.

During the Great Recession, 1 percent net worth dipped to a low of 27.4 percent in Q1 of 2009, down from a previous high of 29 percent in 2007. However, by early 2011, the wealth of the 1 percent had already recovered to pre-crisis levels. For the top 10 percent, this was the case as early as Q3 of 2009. Regular Americans, on the other hand, took 3.5 times as long to recoup their recession losses. While they owned an (already meager) 2 percent of U.S. wealth in mid-2007, it took them until mid-2020 to get back to this level – a disheartening historical rupture clearly visible in the Fed data.

Conversely, the wealth of the bottom 50 percent was not affected as severely by the pandemic as that of richer Americans, as many consumers reported saving money due to the nature of the crisis making people stay at home, commute less and travel less. The net worth of the bottom 50 percent percent rose to 2.7 percent until mid-2022, surpassing pre-Great Recession levels but never rising quite as high as figures out of the 1990s, which reached around 4 percent. Around the time when the global effects of the Russian invasion of Ukraine began to negatively affect the world economy and financial markets, including inflation and personal equity investments, the group’s wealth started to fall again very slightly, from a high of 2.7 percent to now 2.5 percent.