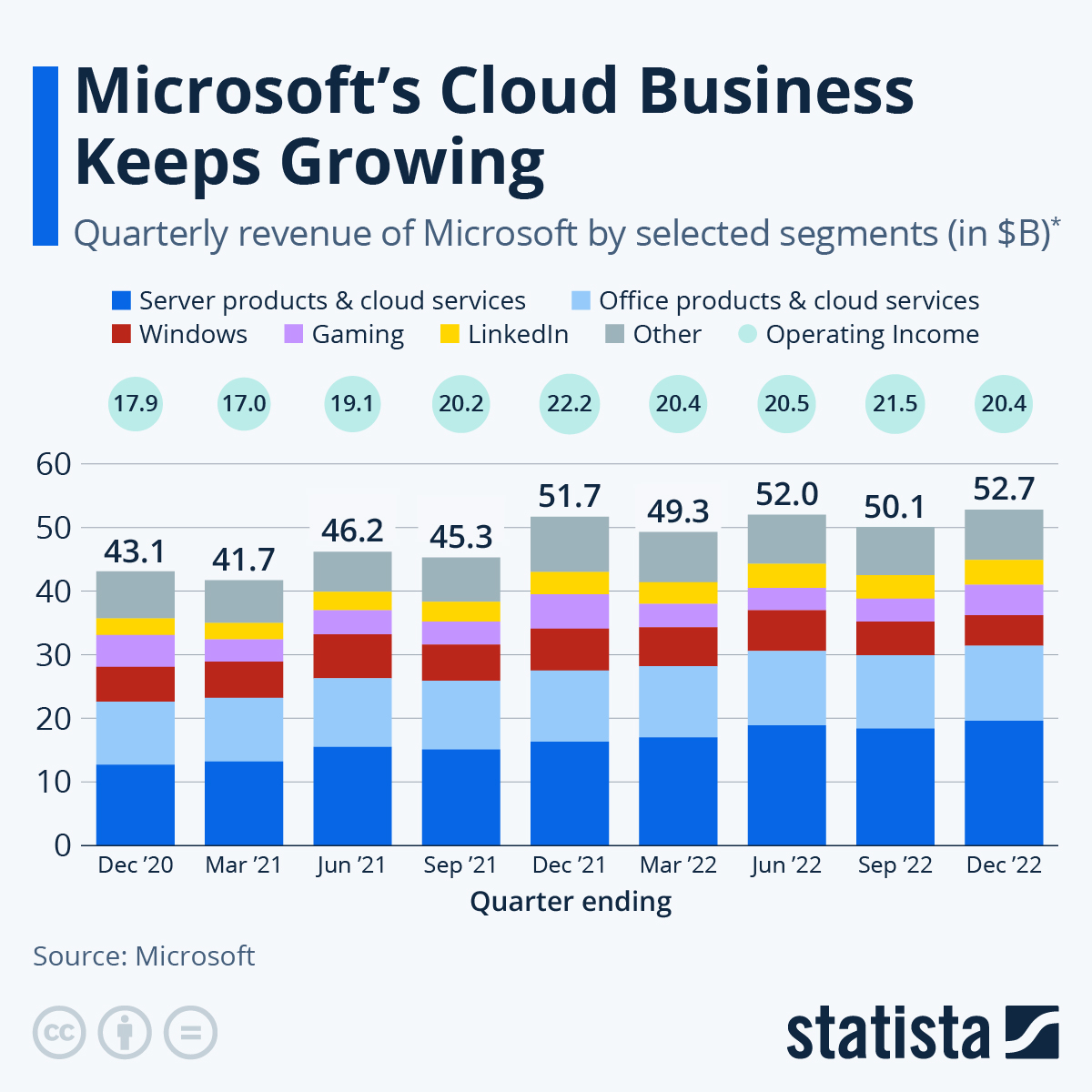

When Microsoft published its financial statements for the quarter ending December 2022, investors and observers were presented with a mixed bag. Although revenue was at an all-time high of $52.7 billion, the tech company's operating income dropped by more than $1 billion compared to the previous three-month period. This can be attributed to a considerable cooling of the PC market, which hit Microsoft's OEM bundling business and resulted in a continued decline of revenue in the Windows segment. The company's saving grace: An increased focus on cloud solutions and AI, hailed by CEO Natya Sadella as the "next major wave of computing" in the accompanying earnings call.

Revenue with cloud products like Azure, Office 365 Commercial and the commercial portion of LinkedIn amounted to $27.1 billion, an increase of $5 billion or 22 percent year over year. Continuing an ongoing trend, the Server and Office segments made up roughly 60 percent of the tech giant's fiscal year Q2 2023 revenue.

Microsoft's gaming branch, which saw record numbers between October 2021 and January 2022, likely due to the continued growth of Xbox Game Pass and the release of the highly anticipated new Halo game, bounced back from its low numbers in the calendar year 2022. Still, its performance turned out to be the worst of any Q4 since the pandemic's start. If the much-discussed acquisition of Activision Blizzard King is successful, this segment could potentially outperform Windows products and become the third-biggest revenue pillar for the company. This move towards further consolidation of the video game market is currently facing increasing headwinds, with European and US regulators heavily scrutinizing the deal.

While cloud revenue has been on the uptick for some time now, the company plans to further bolster its revenues in this segment with an investment of $10 billion in ChatGPT creator OpenAI and securing an exclusive cloud provider deal between the AI non-profit turned startup, effectively integrating OpenAI into many of Microsoft's products. This also includes its search engine Bing, a plan that caused competitor Google to issue a Code Red, which signifies a severe threat to its business model, and to announce a stronger focus on Google-developed AI solutions.