China is currently grappling with how to solve its problem of making too many solar power panels, following decades of state subsidies and support for its solar sector. This oversupply of solar panel manufacturing capacity has driven down global PV panel prices and led to job cuts in the Chinese solar industry, with several of the country’s leading solar power companies reporting losses in the first half of this year.

Reuters reports that Chinese producers of polysilicon, a material is used in solar panels, are contemplating creating a $7 billion fund to buy and shut down production capacity, reducing roughly a third of output. A lower supply could then allow for panel prices to rise again.

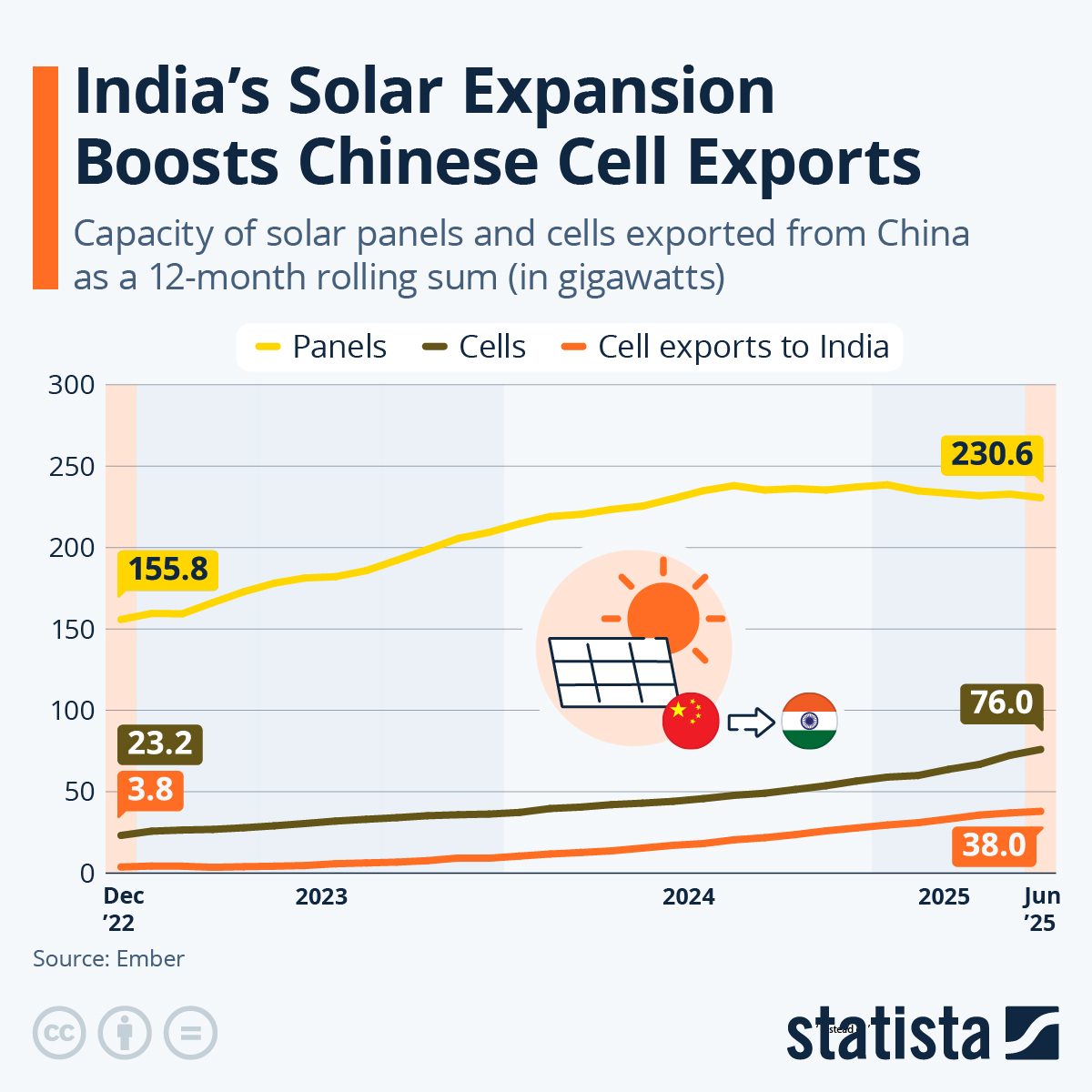

Against this backdrop, Ember has released new data showing that China’s total exports of solar power panels stagnated in the first half of 2025. Ember analysts state this is largely due to stockpile drawdowns and slowing installations in Europe and Brazil, the latter of which has had delays with grid connection availability.

But the data highlights a new shift too, as Chinese exports of the cells and wafers which used to make PV panels are growing. This increase is largely driven by demand from India, which is currently ramping up its own domestic production of solar panels and needs to import PV cells to use in their production lines. According to Ember, Chinese cell exports to India having increased from 11 GW in the first six months of 2024 to 21 GW in the first half of 2025.