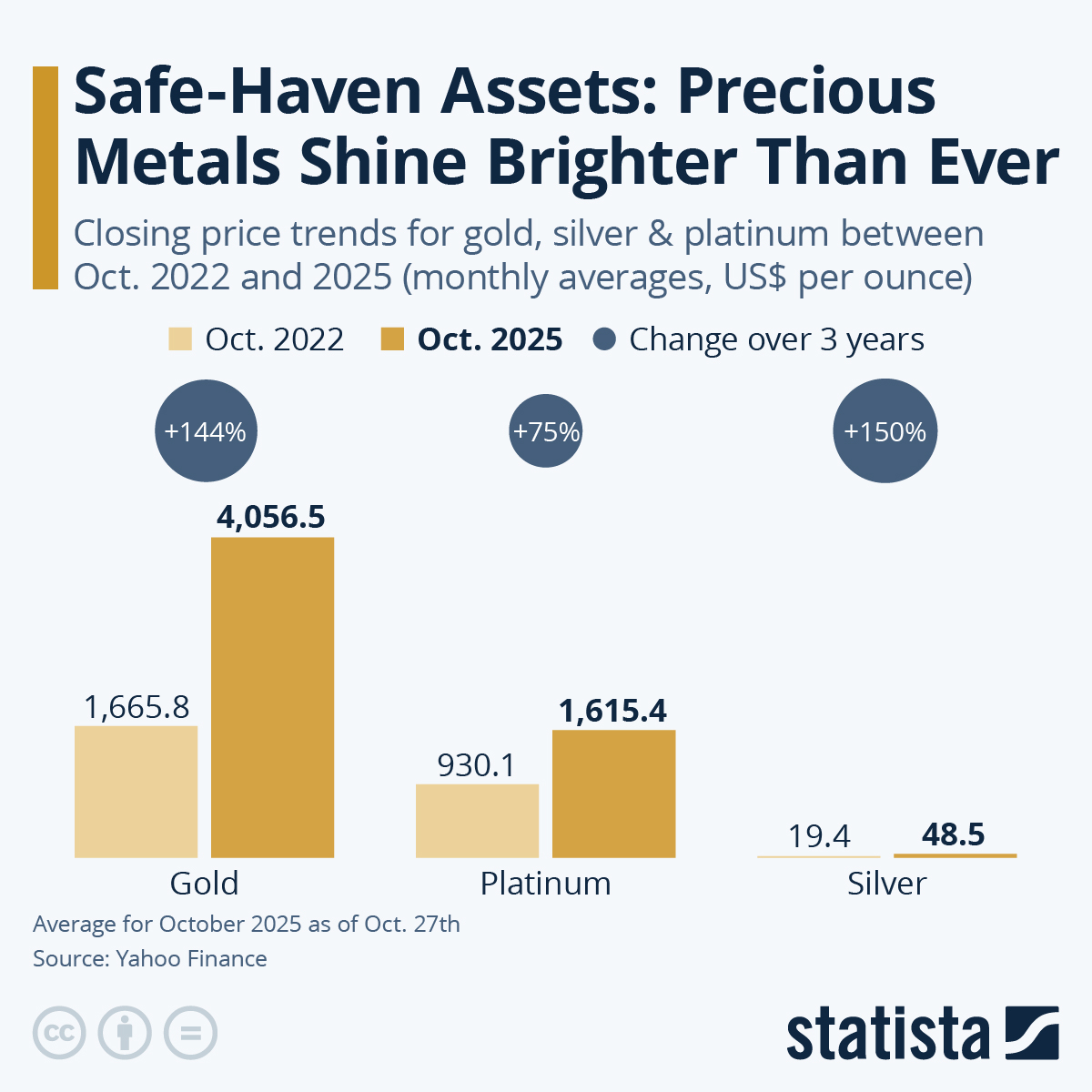

Precious metals, such as gold, silver or platinum, have recently reaffirmed their status as safe-haven assets, with their price trends reflecting global economic uncertainty, geopolitical tensions and shifting monetary policies.

The most popular of all, gold, has experienced a remarkable rally, reaching unprecedented heights. During the month of October 2025, gold prices have surged to over $4,000 per ounce on average (1 ounce = 28 grams, the weight of a large coin), marking a historic milestone and a 144 percent increase since October 2022. This rally was fueled by persistent geopolitical instability, such as the ongoing Russia-Ukraine conflict and U.S.-China trade tensions.

Silver's price trajectory has been very similar: from around $19 per ounce on average in October 2022 to over $48 per ounce three years later, a gain of 150 percent. This surge reflects both its safe-haven status and a growing industrial demand for silver, particularly in technologies like solar panels and electric vehicles, while supply shortages and speculative interest have further amplified price movements.

Platinum, though less prominent than gold or silver, has also seen a significant price appreciation recently, mostly driven by supply deficits (sanctions on major producers like Russia) and industrial demand, especially in the automotive sector. From a little over $900 per ounce in October 2022, platinum's price has risen to around $1,600 per ounce in October 2025, an increase of 75 percent over the last three years.