It’s no secret that many Americans are struggling to stay afloat, living paycheck to paycheck as they juggle payments for groceries, medical bills and other expenses. In this environment, it’s no surprise that credit card debt is at record highs. According to data from the New York Fed’s latest Household Debt and Credit Report, Americans collectively hold $1.23 trillion in credit card debt, up 33 percent over the past three years.

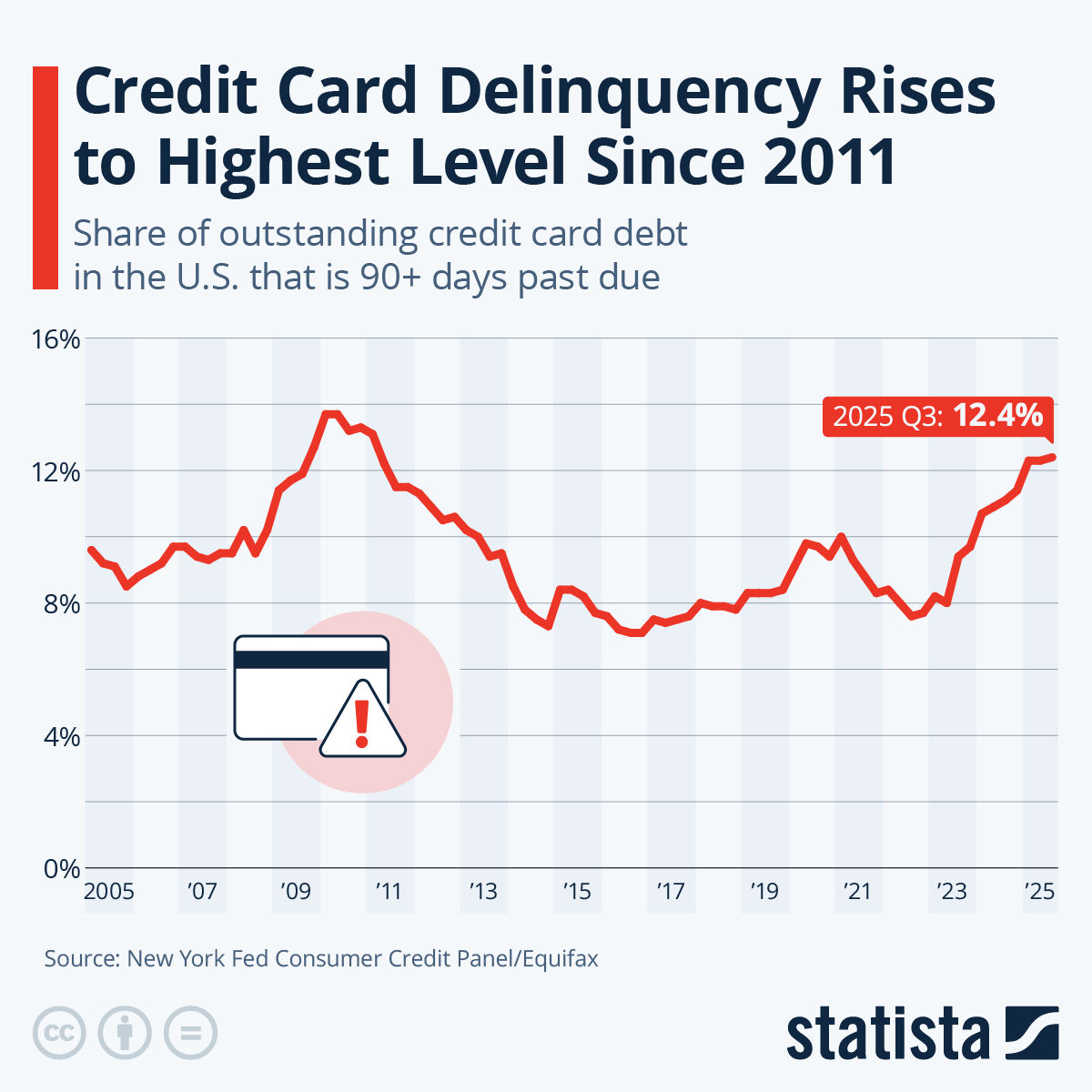

And while credit card debt is not a problem per se, as credit card balances are more indicative of spending than they are of borrowing these days and most credit card debt is paid off every month without accruing interest, a growing number of Americans are struggling to pay their credit card bills on time. According to the New York Fed, 12.4 percent of credit card debt in Q3 2025 was seriously delinquent, i.e. at least 90 days late.

That’s the highest share since Q1 2011, when people were still reeling from the aftermath of the Great Recession. And while delinquency rates are still relatively low overall, with 95.5 percent of total household debt serviced on time, the growing pile of overdue credit card debt is a signal of financial stress for at least some households.