Snapchat’s parent company Snap officially filed for its IPO on Thursday, lifting the veil on how the company is doing prior to its planned public offering in March. Seeking a valuation of $20+ billion, the IPO will likely be the largest of a U.S. tech startup since Twitter went public in late 2013.

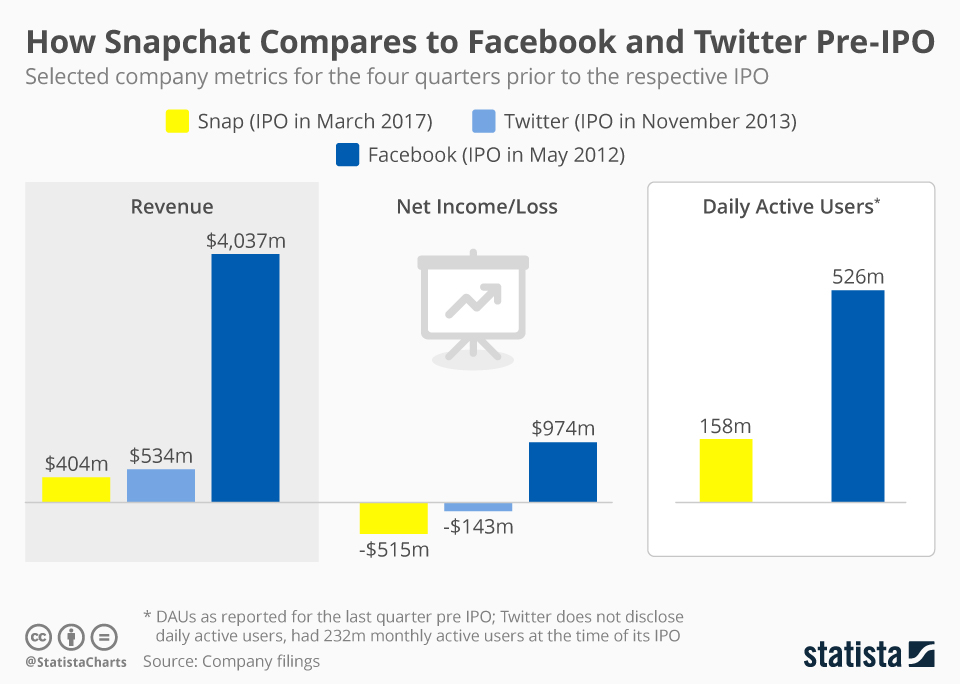

Speaking of Twitter, how does Snapchat compare to its prominent predecessors? As our chart illustrates, Facebook was an entirely different beast when it filed for its blockbuster IPO in 2012, which valued the company at $104 billion. Back then, Facebook had more than 500 million daily active users, generated $4+ billion in revenue a year and was actually profitable. Snap lost more money than it made last year and, while respectable, its 158 million daily users are nowhere near Facebook’s levels. To be fair, Snap plans to raise $3 billion at a valuation of around $20 billion compared to Facebook’s $16 billion at a valuation of $104 billion. So comparing the two may not be entirely fair.

So let’s take a look at Twitter, whose initial public offering was closer in size to what Snapchat’s parent is planning. Twitter’s revenue at the time was 32 percent higher than Snap’s is now and, more importantly, it didn’t hemorrhage cash at the same rate as Snap does. In terms of users however, Snap probably has the edge over Twitter, which refuses to disclose daily user tallies but had 232 million monthly active users at the time of its IPO. Unless those users showed exceptionally high engagement, it can safely be assumed that Twitter’s daily active user base was smaller than Snapchat’s 158 million.

How Snapchat Compares to Facebook and Twitter Pre-IPO

Snap files for an IPO

Description

This chart compares key metrics of Snapchat, Facebook and Twitter prior to their respective IPOs.