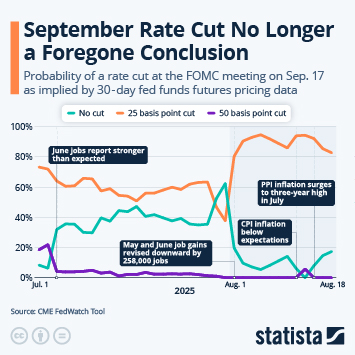

The U.S. Federal Reserve cut its benchmark interest rate by a quarter of a percentage point for the second time this year on Wednesday, bringing it down to a range of 3.75 to 4.00 percent. The precedent cut was done just last month. By lowering rates gradually, the Fed seeks to strengthen the job market without putting too much upward pressure on prices. During a speech in October, Chair Jerome Powell explained that the Fed navigates "the tension between employment and inflation goals" and that there is currently no "risk-free path." He added yesterday that monetary policy was not predetermined and that "a further reduction in the policy rate at the December meeting is not a foregone conclusion."

As our infographic shows, the main European central banks - the European Central Bank and the Bank of England - have also progressively lowered their key interest rates this year in response to the recent disinflation on the continent and to stimulate economic activity. The Bank of England already cut it three times by 25 basis points, in February, May and August, from 4.75 to 4.00 percent, just like the ECB in March, April and June, from 2.90 to 2.15 percent.