Netflix posted a third-quarter earnings miss on Tuesday, citing a tax dispute with Brazilian authorities. The company says they do not expect it to impact future results. Meanwhile, revenue for July through September rose 17 percent from last year to $11.51 billion, driven by membership growth, subscription price hikes and increased ad revenue, as the company continues to invest in its advertising tier. Netflix had a strong content slate in Q3, including the second season of Wednesday (114M views) as well as KPop Demon Hunters (325M views), which has become the company’s most-watched original movie.

In recent years, the streaming giant has expanded its production of content from countries outside of the United States. Last quarter, just some of the international titles it released included Alice in Borderland (20M views) from Japan, Billionaires’ Bunker from Spain (22M views) from Spain, Bon Appétit, Your Majesty (32M views) from South Korea and The Ba***ds of Bollywood (9M views) from India. While the aforementioned KPop Demon Hunters is an American-made film, heavily inspired by Korean popular culture, it shows how Netflix is tapping into global trends and interests.

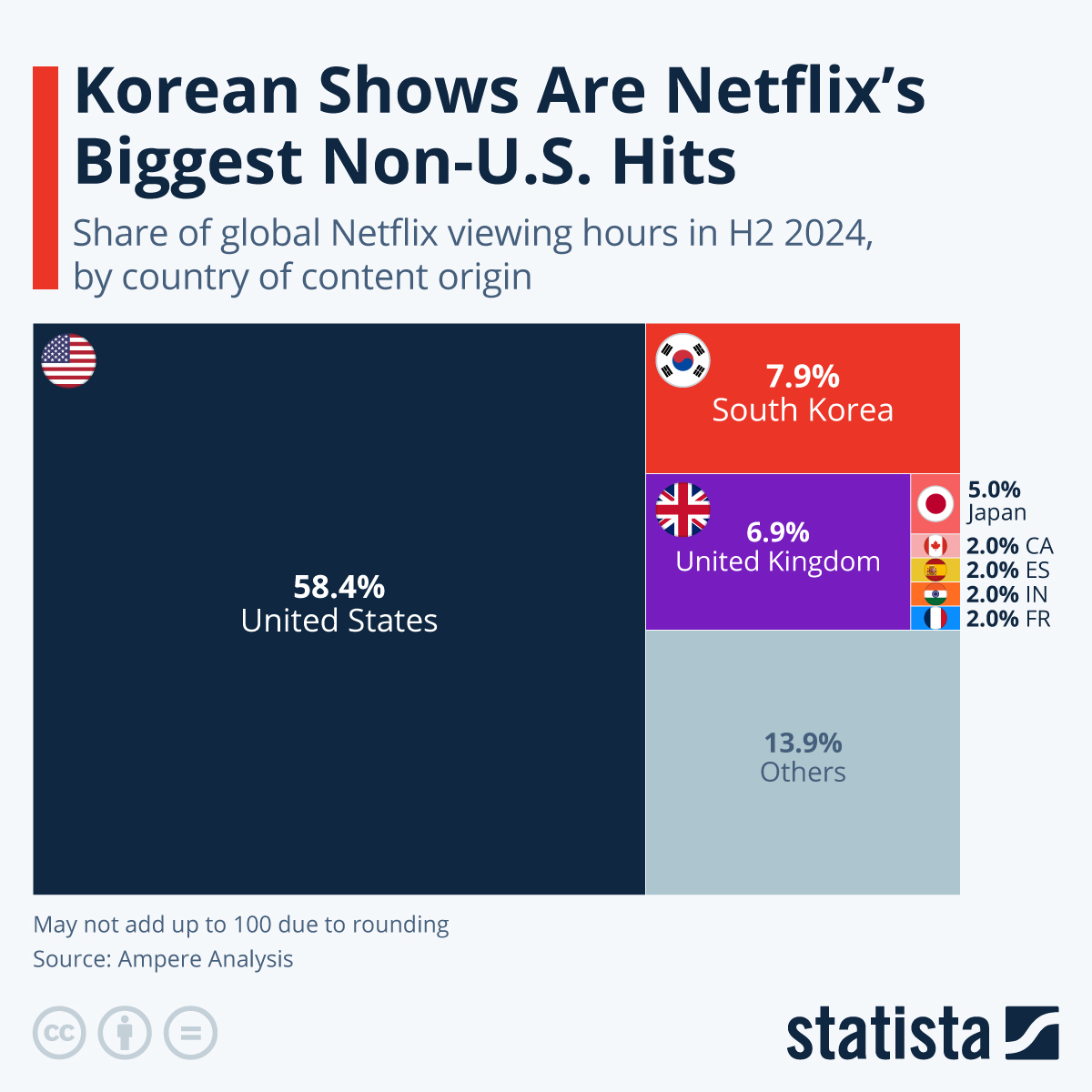

Data from Ampere Analysis shows that worldwide, South Korean shows have become particularly popular. In the second half of 2024, these titles were Netflix’s most watched non-U.S. content, accounting for around eight percent of global Netflix viewing hours. The United Kingdom came close behind with around seven percent of the global share, followed by Japan with five percent, marking an uptick of one percentage point between H2 2023 and H2 2024. As the following chart shows, U.S.-made content still made up the vast majority of global Netflix viewing hours at 58 percent.

Among U.S. audiences specifically, Japanese titles are gaining popularity. Ampere analysts note that between Q2 2022 and Q2 2025, the share of Japanese content among all non-U.S. titles increased from 13 percent to 29 percent, driven partly by a growing interest in anime and Japanese dramas. This boost, following the success of titles such as One Piece, Naruto, Demon Slayer and Dandadan, has led Japanese content to become the top non-U.S. production country in Netflix’s North American catalogue. As titles from countries such as Japan and South Korea have seen growing representation in the U.S., the share of titles from the UK has decreased (falling from 26 percent of all non-U.S. content in 2022 to 17 percent in 2025).