Major changes to different parts of Affordable Care Act premiums are likely to send insurance costs for Americans soaring next year, according to an analysis by KFF. After the U.S. government shutdown ended with only a limited compromise and no extention of healthcare-related tax credits that Democrats were asking for, this is now more likely than ever.

The ACA, established in 2010 under President Barack Obama, offers health insurance at competitive and standardized rates to Americans who aren’t covered under low-income programs like Medicaid or Medicare or through their employers.

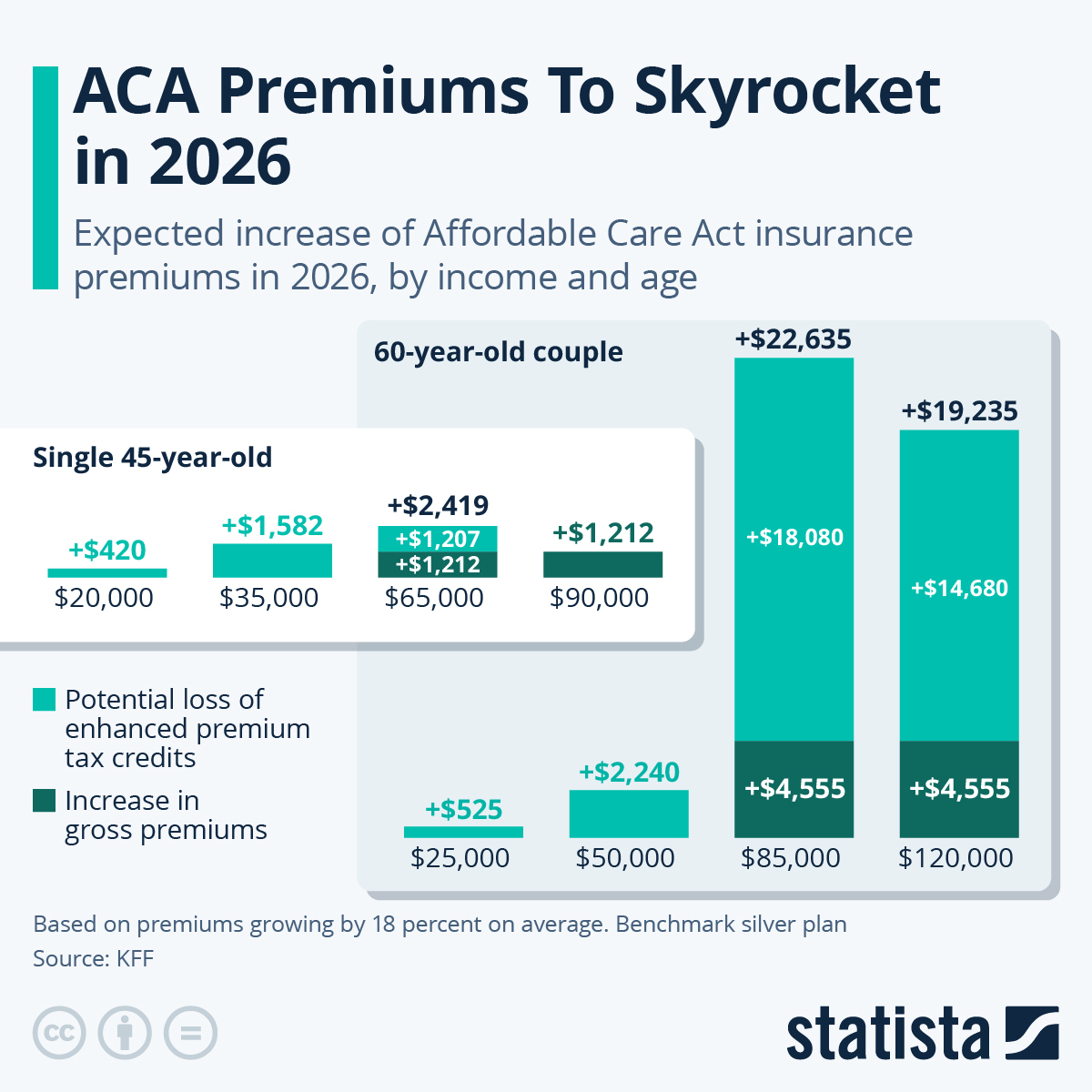

The published data shows that Americans with medium-sized incomes are most likely to see their health insurance costs skyrocket. This is because insurers are upping premiums in 2026 and enhanced premium tax credits are due to expire at the end of 2025, leaving those with incomes of more than 400 percent of the federal poverty level without a price cap for their coverage.

Americans with lower incomes would still be able to benefit from income-percentage price caps, even if they are a little higher under the new tax rules in lieu of enhanced credit. Those with much higher incomes had not been hitting their caps previously, so they were paying market rates anyway and are not affected by cap changes. This leaves those with medium incomes in the rain, as they are shouldering both price increases by insurers as well as cap eliminations (while a someone with a much higher income would only pay the price increases from insurers).

For example, a 45-year-old individual covered under a benchmark silver plan earning $65,000 a year (415 percent of federal poverty line) would see a cost increase of almost $2,500 annually. Cap changes and insurers’ price increases would each up insurance cost by more than $1,200 for a person with the above characteristics. A 45-year-old earning $90,000 (575 percent of FPL) would see an increase of around $1,200 in insurers’ cost only.

The calculation changes a bit in the case of a 60-year-old couple due to the cost of coverage being higher for older people. At an annual income of $85,000 (402 percent of FPL), combined cap and insurance cost increases would see premiums soar by an astonishing $22,000 per year. At a $125,000 income (591 percent of FPL), the couple would still have hit its cap previously and would pay an additional $19,000 in combined cap elimination and insurers’ premium increases.

The KFF calculation from the end of September is based on insurers’ premiums rising by 18 percent on average. At the end of October, KFF said that it now expects those premiums to rise by 26 percent.