Crowdfunding in Europe - statistics & facts

Today, crowdfunding has evolved into a significant component of the global financial technology sector, with North America leading the way. In 2023, the North American market demonstrated its dominance with digital capital raising volumes in the region exceeding 36 billion U.S. dollars. Europe has also established itself as a vital crowdfunding hub, with digital capital raising value reaching nearly 10 billion U.S. dollars in 2023, primarily driven by crowdlending activities. Within the European market, the United Kingdom maintains its position as the largest digital capital raising center, followed by Germany and Italy, highlighting the continent's growing embrace of alternative financing methods.

European crowdfunding platforms: a landscape of growth and consolidation

The European crowdfunding landscape is characterized by a diverse ecosystem of platforms, with the United Kingdom and Germany leading in platform density – each hosting over 100 active crowdfunding platforms in 2023. Despite this substantial number of platforms, most operate with a relatively modest backer base, with the majority of European platforms reporting fewer than 500 active investors in 2022. The fundraiser profile varies significantly across different crowdfunding models and regions, though small and medium-sized enterprises (SMEs) consistently dominate both equity crowdfunding and lending segments. This suggests that crowdfunding has become particularly valuable for business financing rather than personal or creative projects in the European context. Notably, the market shows signs of maturity and consolidation, with only 22.5 percent of platforms reporting annual crowdfunding volumes below one million euros in 2022, indicating that most platforms have achieved sustainable operational scale.Kickstarter: the global crowdfunding pioneer

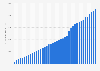

Kickstarter stands as a testament to the transformative power of crowdfunding, with the cumulative amount of dollars pledged to project funding exceeding eight billion U.S. dollars on the platform in by September 2024. This remarkable milestone reflects the platform's enduring appeal and its ability to connect creative projects with enthusiastic backers worldwide. The platform's most successful campaign to date showcases the extraordinary potential of crowdfunding when combined with established creator appeal. In 2022, author Brandon Sanderson's "Surprise! Four Secret Novels" campaign shattered previous records by raising an unprecedented 41.75 million U.S. dollars, demonstrating the platform's ability to revolutionize traditional publishing models. While Kickstarter hosts projects across various categories, gaming and music consistently emerge as the most successful sectors. These categories have built particularly engaged communities of backers who regularly support new projects, from indie game developers to emerging musicians.As crowdfunding continues to evolve and mature, it represents not just an alternative funding mechanism, but a fundamental shift in how we think about financing projects and businesses in the digital age. The success stories from platforms like Kickstarter and the growing institutional adoption in markets like the UK and Germany suggest that crowdfunding will play an increasingly vital role in shaping the future of finance, bridging the gap between innovative ideas and the capital they need to thrive.