Online Shopping: Where The Parcels Are Piling Up

Parcels

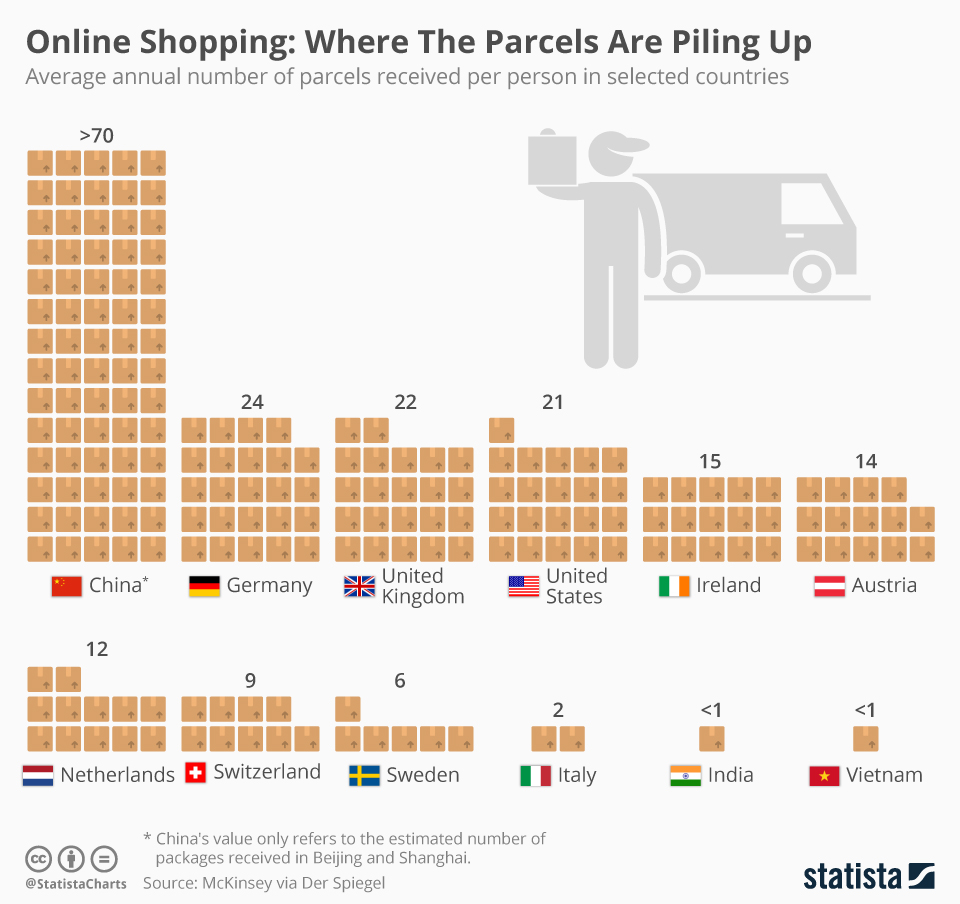

The American quota is also less than Germany and the United Kingdom where people received 24 and 22 parcels per year respectively on average. In other European countries, the parcel pile came to 15 in Ireland, six in Sweden and only two in Italy. The volume is less in the developing world where there is enormous potential for growth. For example, an average person in India only receives one parcel per year. That's also true in Vietnam, Malaysia and Thailand while someone living in Indonesia would receive two. McKinsey said that classic parcel delivery services are coming under more pressure from online retailers such as Amazon who are starting their own delivery services. That means that traditional deliverers will have to become more innovative to remain competitive in an increasingly crowded market.

Description

This chart shows the average number of parcels received per person in selected countries.