Europe economic outlook 2024 - statistics & facts

Europe's post-pandemic recovery hit several stumbling blocks over 2022 and 2023, as the continent was struck by an energy shock and refugee crisis in the beginning of 2022, precipitated by Russia's war of aggression against Ukraine, which stretched the finances of both consumers and public authorities. Combined with rising interest rates, this meant that demand in Europe remained weak and hence Europe's growth in 2023 was much shallower than in the United States. In 2024, however, the tables may begin to turn as the return of positive real wage growth, the end of the inflation and energy crises, and the excess savings which Europeans built up over the past years, but are yet to spend, may boost consumer demand in Europe. GDP growth is therefore predicted to increase from around 0.8 percent in 2023, to over 1.4 percent in 2024. While within the European economy there may be causes for optimism, the international situation remains volatile with the potential for negative spillovers from several regional conflicts - a key risk for highly export-dependent countries such as Germany.

The end of the post-pandemic inflation crisis and the ECB's interest rate dilemma

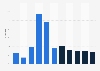

The disinflation being experienced across most of Europe's major economies - while being a generally positive sign for Europe's economy - will raise new questions for central banks in 2024. The European Central Bank, Bank of England, and other key European central banks moved to raise interest rates to historically high levels in 2023, with the intent of slowing the rate of inflation by increasing the price of money. While this strategy has appeared to have worked so far, falling inflation means that central banks must now consider whether they will need to cut rates in 2024 in order to prevent their economies from falling below their two percent inflation targets. A worst case scenario would be that due to the delayed transmission of the effect of higher interest rates in Europe, some economies could enter a recession and deflationary period - that is, a period of falling prices - due to the slowing down of investment and demand.On the other hand, central bankers are also wary to lower rates too soon while the risk of further inflation still remains. Therefore, while it is predicted that the ECB will lower rates in 2024 - with its main refinancing operations rate forecast to decrease from 4.5 percent to 4.15 percent - the pace of decreases in interest rates is likely to be much slower than the pace at which they rose during 2023, while any slowdown in disinflation is likely to result in central banks pausing these rate cuts. Food and beverage price inflation, a key component in the high inflation of the past years, is set to decline from 10.9 percent in 2023 to 3.2 percent during 2024. This category, along with other categories such as leisure goods and services, are still the greatest contributor to overall consumer price inflation in Europe and will be watched keenly by central bankers looking for areas of the economy where inflation is proving to be less transitory than expected.

An unstable global political situation could still upset Europe's economy in 2024

Many European countries are highly dependent on exports, meaning that the potential for conflict between the United States and China - the EU's largest trade partners outside of Europe - remains high on the list of risks over the next year. The meeting of U.S. President Joe Biden and Chinese leader Xi Jinping in late-2023 may have somewhat eased fears, but the potential for tensions to escalate into a wider geopolitical conflict will be tested by the reactions of Beijing and Washington to the elections in Taiwan during January of 2024. While the energy crisis caused by European countries sanctioning Russia in the aftermath of the invasion of Ukraine in 2022 has largely passed, countries in Eastern Europe, notably the Baltics, are exposed to a possible further escalation of the conflict in 2024, which would risk a deteriorating international economic situation, as well as further waves of refugees from Ukraine. The Israel-Hamas war in the Middle East also poses a risk to Europe's economy in the coming year, as the possibility of a wider conflict in the region would jeopardize Europe's energy supply and disrupt global trade routes - a trend which has already started with the disruptions since late-2023 in the Suez Canal trade route.Political shocks may not only come from abroad in 2024, as the European Union heads to the polls in June to vote for the European Parliament, with a possible far-right and eurosceptic surge casting a shadow over future European integration and plans for the enlargement of the EU. The ambitious green agenda of the European Union and many European countries - the EU plans for Europe to be the first climate neutral continent by 2050 - will also face its greatest challenges yet in 2024. Already in 2023, political tremors have been felt in Germany, with battles over the government's climate-friendly heating law, and in the Netherlands, where an agrarian party which opposes the country's plan to drastically cut nitrogen emissions won the provincial elections. While investments in green technologies, renewable energy infrastructure, and other aspects of the green transition need to increase in pace to meet the EU's goal of reducing emissions to 55 percent of their 1990 levels by 2030, increasing political pushback is likely to make this more complicated in 2024.