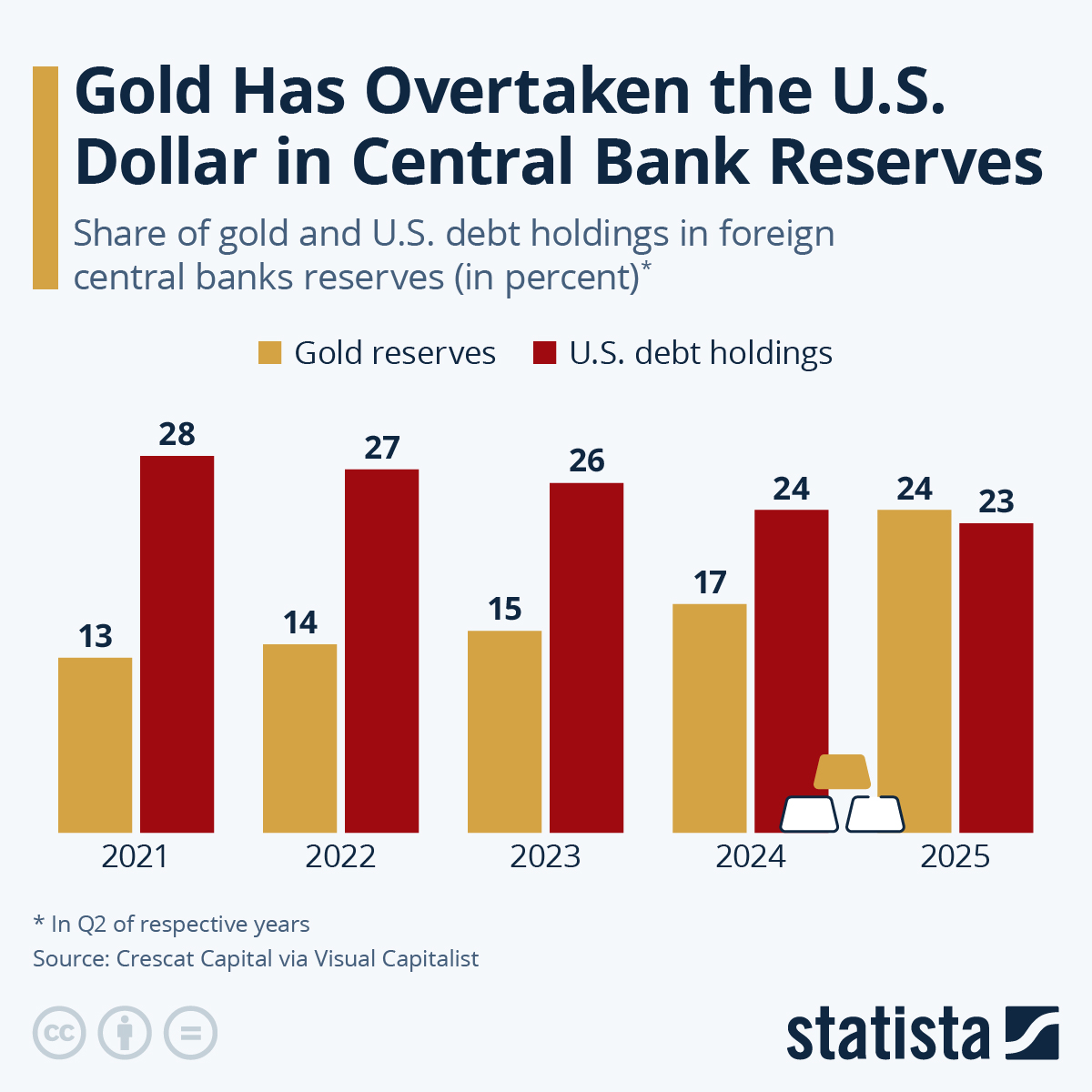

For the first time since 1996, foreign central banks now hold more gold than U.S. Treasuries (U.S. debt) in their reserves, marking a historic turning point in global reserve management. Data published by Visual Capitalist reveals that, in the course of 2025, the share of gold in central bank reserves surpassed that of U.S. debt holdings, a trend driven by rising geopolitical uncertainty and a quest for asset diversification.

Between 2021 and 2025, central banks - particularly in emerging markets like China, India and Turkey - significantly increased their gold holdings. This move reflects a broader strategy to reduce reliance on the U.S. dollar, undermined by soaring debt levels and geopolitical tensions. Gold, seen as a durable, portable and neutral asset, has become a preferred hedge against currency volatility and inflation. At the beginning of 2026, gold prices surged to record highs as demand for safe-haven assets intensified.

Gold holdings overtaking U.S. Treasuries signals a rebalancing of global reserves, with implications for the dollar's global dominance. As central banks diversify their reserves in an era of economic and political uncertainty, gold’s timeless appeal as a store of value is stronger than ever.