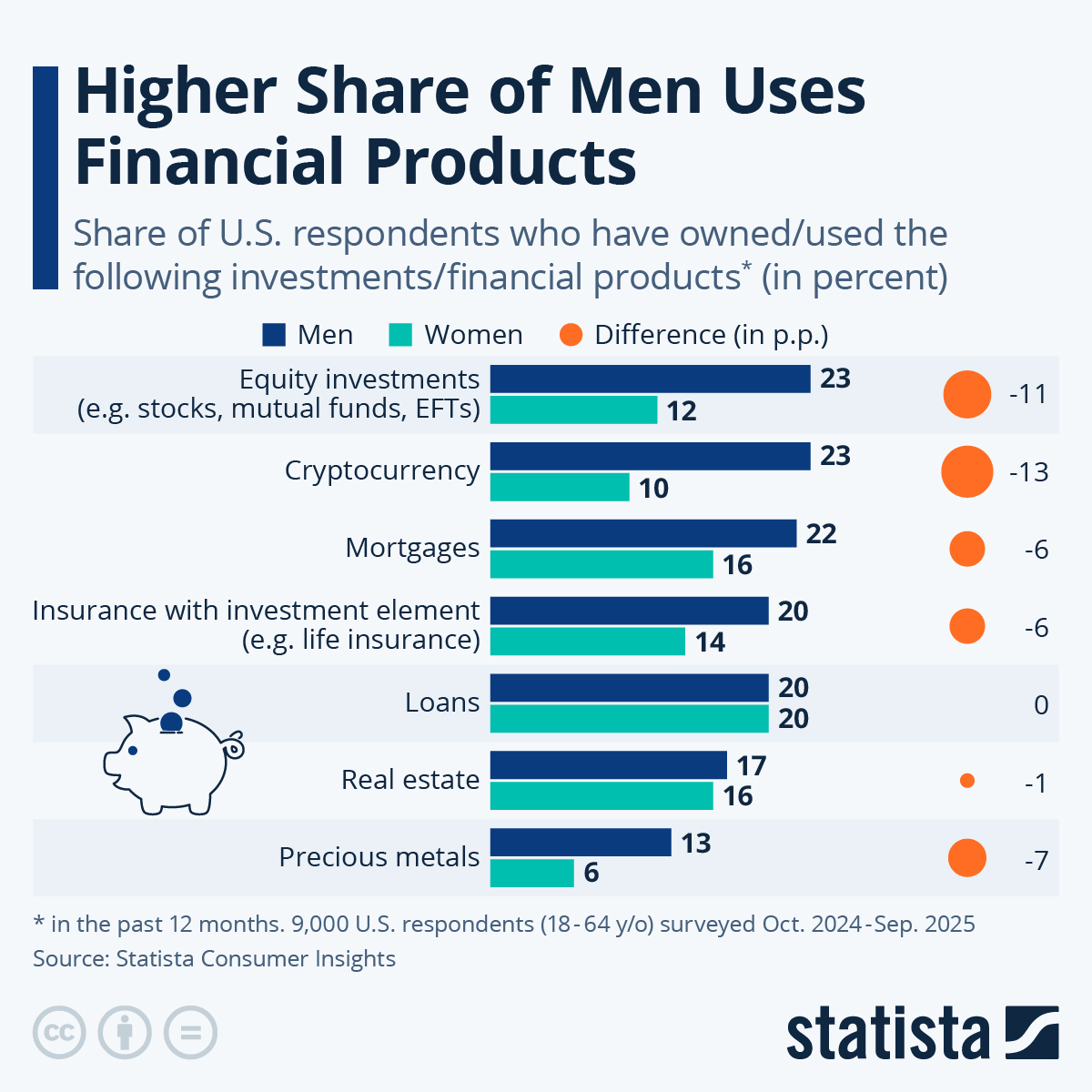

U.S. women are still lagging behind when it comes to financial products. These are used more frequently by men, as a survey by Statista Consumer Insights shows. Men's advantage is particularly large in the areas of equity investments such as stocks and mutual funds as well as cryptocurrencies. The gap in use is less pronounced for loans, mortgages, insurances with investment elements, real estate and precious metals.

It is noticeable that women are more hesitant than men, especially when it comes to riskier financial products. This is consistent with the results of various Kantar surveys, which show that women are more security-conscious and less confident about investing than men.

While security is valued by many investors, the potential return on an investment is also a priority for some, but not all. Despite many past years with zero interest rates, many Americans have remained loyal to their savings accounts.