Meditation and mental wellness apps - statistics & facts

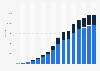

Meditation is a well-established practice for emotional regulation that has accompanied humans from different traditions and geographical backgrounds. With proven effects when treating stress and stress-related symptoms, meditation apps have become an increasingly accepted product for users to develop healthy relaxation practices and practice self-compassion. In 2022, the global market for meditation and mental wellness apps was estimated to have reached over 533 million U.S. dollars. By 2028, meditation apps are projected to surpass 2.6 billion U.S. dollars in revenues from worldwide users.

Global adoption acceleration and trend normalization

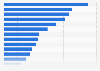

The 2020 outbreak of the COVID-19 pandemic provided global users with a set of unprecedented, worrisome factors, from health concerns to job insecurity. According to a survey conducted in G7 countries, between seven and eight over 10 respondents reported their psychological health was affected by the coronavirus pandemic. In this scenario of elevated stress and anxiety, meditation and mental wellness apps saw a sudden surge in organic adoption. Between January and October 2020, global downloads of apps focusing on emotional well-being increased 42 percent year-over-year, reaching almost 100 million. While mobile-based meditation and mindfulness apps are not an adequate substitute for clinical psychological support in case of need, the meditation and mental wellness apps helped users regain their focus and deal with anxious or depressive states during the pandemic.As of October 2022, the accelerated adoption trend of apps in this category appears to have slowed down, with mental health, meditation, and sleep trackers making up not more than 15 percent of the total app downloads in the health category for U.S. consumers. Between the end of 2019 and the third quarter of 2022, both awareness of meditation apps and intention to use them improved substantially among U.S. consumers. However, usage experienced a true forward leap – if during the third quarter of 2019 approximately 12 percent of U.S. consumers reported having used or using a meditation app, the share of users grew to 20 percent during the third quarter of 2022. At the beginning of 2023, younger digital U.S. audiences aged between 18 and 34 years reported higher usage and appreciation of meditation apps, while 37 percent of U.S. respondents aged over 35 did not use the apps and were not interested in using them in the future.

Mobile meditation market leaders: Calm & Headspace

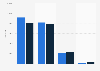

In 2022, the average revenue per user (ARPU) of meditation apps was over 46 U.S. dollars, but the global average spending per user is expected to increase to 60 U.S. dollars by the end of 2027. In the growing mobile-guided meditation market, two companies have emerged as leaders: Calm and Headspace. Launched in May 2012, Calm was the highest-grossing meditation app worldwide in May 2023 with over six million U.S. dollars in revenues. Second-ranked Headspace was originally launched in 2010 in the United Kingdom, and saw revenues of approximately 3.7 million U.S. dollars for the month.Calm and Headspace are apps proposing guided meditations and healthy emotional coping strategies to deal with stress. Both apps operate on subscription models, with users being able to purchase monthly, yearly, or lifetime plans. While downloads have experienced a decrease from the first quarter of 2020 to the first quarter of 2023 for both Calm and Headspace, Calm has seen its revenue grow to 22.54 million U.S. dollars at the beginning of 202, up by 10 percent compared to the beginning of 2020. In comparison, Headspace was able to maintain its second place and generate over 15 million U.S. dollars in revenues during the first quarter of 2023, despite the decrease in downloads.