Lai Lin Thomala

Research expert covering Greater China

Detailed statistics

Leading gaming markets worldwide 2023, by revenue

Detailed statistics

Number of mobile gamers in China 2013-2023

Detailed statistics

Market value of eSports in China 2019-2025

Global gaming penetration Q1 2024, by country

Share of internet users worldwide who play video games on any device as of 1st quarter 2024, by region

Number of gamers in China 2014-H1 2024

Total number of game users in China from 2014 to 1st half 2024 (in millions)

Video gaming revenue in China 2014- H1 2024

Total revenue of video game industry in China from 2014 to 1st half 2024 (in billion yuan)

Average revenue per user of video games in China 2014-2023

Average revenue per user of video games in China from 2014 to 2023 (in yuan)

Overseas revenue of video games developed in China 2013-2023

Overseas revenue of video games developed in China from 2013 to 2023 (in billion U.S. dollars)

Sales revenue of domestically developed video games in China 2014-2023

Domestic sales revenue of homegrown video games in China from 2014 to 2023 (in billion yuan)

Video gaming revenue CAGR forecasts in China 2020-2025, by type

Forecasted revenue growth of video gaming industry in China from 2020 to 2025, by type

Game sales revenue in China 2023, by segment

Sales revenue of the gaming industry in China in 2023, by market segment (in billion yuan)

Sales revenue share of Chinese gaming industry 2023, by segment

Share of sales revenue in the gaming industry in China in 2023, by segment

Mobile game actual sales revenue in China 2013-2023

Mobile game actual sales revenue in China from 2013 to 2023 (in billion yuan)

Actual sales revenue of eSports game market in China 2016-2023

Actual sales revenue and YoY growth of eSports game market in China from 2016 to 2023

Domestic revenue of PC games in China 2023-2028

Domestic revenue of PC games in China in 2023, with estimates until 2028 (in billion U.S. dollars)

Game client sales revenue in China 2013-2023

Annual revenue from game clients in China from 2013 to 2023 (in billion yuan)

Browser game sales revenue in China 2013-2023

Revenue of browser games in China between 2013 and 2023 (in billion yuan)

Console gaming revenue in China 2020-2023

Actual sales revenue of console game industry in China between 2020 and 2023 (in billion yuan)

Game revenues of global companies 2023

Estimated gaming revenue of leading gaming companies worldwide in 4th quarter 2023 (in million U.S. dollars)

Leading Chinese video game listed companies based on revenue 2023

Annual gaming revenue of leading Chinese public companies in 2023 (in billion yuan)

Ranking of Chinese global mobile gaming brands according to BrandZ 2024

Leading Chinese global mobile gaming brand builders in 2024 (in BrandZ brand power scores)*

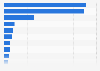

Leading Chinese mobile game publishers 2024, based on monthly app revenue

Global game app revenue of Chinese mobile game publishers in September 2024 (in million U.S dollars)

Mobile gaming app revenue in China 2024, by publisher

Revenue of mobile games applications in China in August 2024, by publisher (in million U.S dollars)

Mobile game app downloads in China 2024, by publisher

Number of mobile games application downloads in China in August 2024, by publisher (in millions)

Most influential online games on Douyin 2024

Most influential online games on Douyin as of May 2024

Most influential video games on Weibo 2024

Most influential video games on Weibo as of May 2024

Top grossing mobile games in China 2024

Leading mobile game apps in China in September 2024, based on monthly revenue (in million U.S. dollars)

Most downloaded free game apps in China 2024

Leading mobile game apps in China in September 2024, based on number of downloads (in millions)

MAUs of popular WeChat mini-games in China 2024

Monthly active users of leading mini-games on WeChat in China in February 2024

MAUs of popular Douyin mini-games in China 2024

Monthly active users of leading mini-games on Douyin in China in February 2024 (in millions)

Monthly game app usage in China 2024

Monthly usage of mobile game apps in China in February 2024

Most used devices for playing video games in China 2023

Usage rate of various devices in playing video games in China as of 3rd quarter 2023

Penetration rate of online games in China 2022, by gender

Share of respondents who played online games in China as of April 2022, by gender

Time spent on video games per day in China 2023, by gender

Average daily time spent playing video games in China in 2023, by gender

Reasons for playing video games in China 2023

Reasons for playing online games in China in 2023

Monthly costs on video games in China 2023

Monthly consumer spending on playing video games in China in 2023

Most popular online game types in China 2022, by payment structure

Online games popularity in China as of April 2022, by payment structure

MAUs of mobile game apps among university students in China 2024, by genre

Number of active mobile game app users among university students in China in February 2024, by genre (in million)

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)