Banking industry in the Netherlands - statistics & facts

Overall, the assets of domestic banking groups reached a value of approximately 2.6 trillion euros in 2023, which was more than twice the size of the Dutch GDP, highlighting the banking sector's prominent role in the country's economy.

Retail banking trends

Retail banking covers a wide range of services, such as card payments and mortgages. For instance, banks are the biggest provider of mortgage loans in the Netherlands, with the three largest banks reaching a combined market share of over 45 percent in 2023. Additionally, card payments in the Netherlands grew in recent years at the expense of cash payments. In 2022, the number of payment transactions at point-of-sale terminals with cards issued was approximately 12.9 billion. In 2023, 64 percent of all e-commerce payment transactions were done with iDEAL. This domestic bank transfer system allows online shoppers to use their debit card for online shopping and is supported by all Dutch consumer banks.Corporate banking's role for SMEs

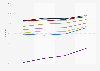

The role of corporate banking within the Dutch economy is a vital one, especially for SMEs. The total amount of outstanding SME loans decreased overall between 2015 and the first half of 2023, with a period of sharp increase during the first quarter of 2021 as a result of government measures implemented due to the coronavirus pandemic. Compared to the EU-average of around 1.8 percent, though, the non-performing loan (NPL) ratio in the Netherlands (the rate at which a bank's loans are not repaid) was significantly lower in 2022, at 1.2 percent.Despite fluctuations, the Dutch banking industry displays strong signals of stability, with recent performance indicators signaling increasing profitability and efficiency after the economic downturn caused by the COVID-19 pandemic. The dominance of the three largest banks - ING, Rabobank, and ABN AMRO - is evidenced by their role both in retail and corporate banking, underscoring their significant influence in the country's economy.