Key insights

- Global programmatic ad spend

- 595bn USD

Detailed statistics

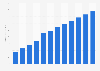

Programmatic ad spend worldwide 2017-2028

- Largest programmatic market worldwide

- United States

Detailed statistics

Largest programmatic markets worldwide 2024

- Programmatic ad spend in the U.S.

- 244bn USD

Detailed statistics

Programmatic ad spending in the U.S. 2017-2027

Editor’s Picks

Editor’s Picks

Current statistics on this topic

Recommended statistics

Overview

9

- Premium Statistic Programmatic ad spending in the U.S. 2017-2027

- Premium Statistic Programmatic ad spend growth in the U.S. 2018-2027

- Premium Statistic Digital ad spend in the U.S. 2023, by purchase method

- Premium Statistic U.S. programmatic ad spend 2023, by purchase method & industry

- Premium Statistic Change in programmatic ad budgets in the U.S. 2024

- Premium Statistic Cookie-based vs cookieless programmatic ad buys in the U.S. 2023, by industry

- Premium Statistic Share of MFA sites in programmatic market worldwide 2023

- Premium Statistic Leading sell-side platforms on iOS in the U.S. & Canada 2023

- Premium Statistic Leading sell-side platforms on Android in the U.S. & Canada 2023

Overview

-

Premium Statistic

Programmatic ad spending in the U.S. 2017-2027

Programmatic ad spending in the U.S. 2017-2027

Programmatic advertising spending in the United States from 2017 to 2027 (in billion U.S. dollars)

-

Premium Statistic

Programmatic ad spend growth in the U.S. 2018-2027

Programmatic ad spend growth in the U.S. 2018-2027

Change in programmatic advertising spending in the United States from 2018 to 2027

-

Premium Statistic

Digital ad spend in the U.S. 2023, by purchase method

Digital ad spend in the U.S. 2023, by purchase method

Distribution of digital advertising spending in the United States in 3rd quarter 2023, by purchase method

-

Premium Statistic

U.S. programmatic ad spend 2023, by purchase method & industry

U.S. programmatic ad spend 2023, by purchase method & industry

Digital advertising spending in the United States between January and September 2023, by purchase method and industry

-

Premium Statistic

Change in programmatic ad budgets in the U.S. 2024

Change in programmatic ad budgets in the U.S. 2024

Share of advertisers who were planning to increase vs decrease their programmatic spending in the United States in 2024

-

Premium Statistic

Cookie-based vs cookieless programmatic ad buys in the U.S. 2023, by industry

Cookie-based vs cookieless programmatic ad buys in the U.S. 2023, by industry

Share of cookie-based vs cookie alternative programmatic advertising buys in the United States in 3rd quarter 2023, by industry

-

Premium Statistic

Share of MFA sites in programmatic market worldwide 2023

Share of MFA sites in programmatic market worldwide 2023

Share of made-for-advertising (MFA) sites in the open internet programmatic advertising spending and impressions worldwide between September 2022 and January 2023

-

Premium Statistic

Leading sell-side platforms on iOS in the U.S. & Canada 2023

Leading sell-side platforms on iOS in the U.S. & Canada 2023

Leading sell-side platforms (SSPs) on iOS in the United States and Canada in 1st quarter 2023, by open programmatic share of voice

-

Premium Statistic

Leading sell-side platforms on Android in the U.S. & Canada 2023

Leading sell-side platforms on Android in the U.S. & Canada 2023

Leading sell-side platforms (SSPs) on Android in the United States and Canada in 1st quarter 2023, by open programmatic share of voice

Display & video

7

- Premium Statistic Programmatic display ad spending in the U.S. 2018-2024

- Premium Statistic Share of programmatic in display ad spend in the U.S. 2018-2024

- Premium Statistic Programmatic ad spend in the U.S. 2013-2023, by device

- Premium Statistic Walled garden programmatic display advertising spending in the U.S. 2021-2025

- Premium Statistic Programmatic digital video ad views growth in the U.S. 2021-2022

- Premium Statistic Programmatic digital video ad views in the U.S. 2022-2023, by device

- Premium Statistic Premium digital video ad views in the U.S. 2021-2023, by transaction type

Display & video

-

Premium Statistic

Programmatic display ad spending in the U.S. 2018-2024

Programmatic display ad spending in the U.S. 2018-2024

Programmatic digital display advertising spending in the United States from 2018 to 2024 (in billion U.S. dollars)

-

Premium Statistic

Share of programmatic in display ad spend in the U.S. 2018-2024

Share of programmatic in display ad spend in the U.S. 2018-2024

Share of programmatic in digital display advertising spending in the United States from 2018 to 2024

-

Premium Statistic

Programmatic ad spend in the U.S. 2013-2023, by device

Programmatic ad spend in the U.S. 2013-2023, by device

Distribution of programmatic digital display advertising spending in the United States from 2013 to 2023, by device

-

Premium Statistic

Walled garden programmatic display advertising spending in the U.S. 2021-2025

Walled garden programmatic display advertising spending in the U.S. 2021-2025

Walled garden programmatic digital display advertising spending in the United States from 2021 to 2025 (in billion U.S. dollars)

-

Premium Statistic

Programmatic digital video ad views growth in the U.S. 2021-2022

Programmatic digital video ad views growth in the U.S. 2021-2022

Change in the number of programmatic digital video ad views in the United States from 1st half 2021 to 1st half 2023

-

Premium Statistic

Programmatic digital video ad views in the U.S. 2022-2023, by device

Programmatic digital video ad views in the U.S. 2022-2023, by device

Distribution of programmatic digital video ad views in the United States in 1st half 2022 and 1st half 2023, by device

-

Premium Statistic

Premium digital video ad views in the U.S. 2021-2023, by transaction type

Premium digital video ad views in the U.S. 2021-2023, by transaction type

Distribution of premium digital video ad views in the United States in 1st half 2021, 1st half 2022, and 1st half 2023, by transaction type

Connected TV

8

- Premium Statistic CTV ad spend in the U.S. 2019-2027

- Premium Statistic CTV ad views in the U.S. 2020-2022, by device

- Premium Statistic CTV ad spend share in the U.S. 2020-2024, by company

- Premium Statistic Shift of media budgets to OTT/CTV in the U.S. 2024, by medium

- Premium Statistic Reasons for shifting ad spend to CTV/OTT in the U.S. 2023

- Premium Statistic Connected TV programmatic advertising household reach in the U.S. 2022-2023

- Premium Statistic Leading CTV advertising challenges in the U.S. 2023

- Premium Statistic Top obstacles preventing CTV ad spending in the U.S. 2023

Connected TV

-

Premium Statistic

CTV ad spend in the U.S. 2019-2027

CTV ad spend in the U.S. 2019-2027

Connected TV (CTV) advertising spending in the United States from 2019 to 2027 (in billion U.S. dollars)

-

Premium Statistic

CTV ad views in the U.S. 2020-2022, by device

CTV ad views in the U.S. 2020-2022, by device

Distribution of connected TV (CTV) ad views in the United States from 2nd half 2020 to 1st half 2023, by device

-

Premium Statistic

CTV ad spend share in the U.S. 2020-2024, by company

CTV ad spend share in the U.S. 2020-2024, by company

Distribution of connected TV (CTV) advertising spending in the United States from 2020 to 2024, by company

-

Premium Statistic

Shift of media budgets to OTT/CTV in the U.S. 2024, by medium

Shift of media budgets to OTT/CTV in the U.S. 2024, by medium

Sources for connected TV (CTV) and over-the-top (OTT) media budgets according to marketers in the United States in 2024

-

Premium Statistic

Reasons for shifting ad spend to CTV/OTT in the U.S. 2023

Reasons for shifting ad spend to CTV/OTT in the U.S. 2023

Leading reasons for shifting media budgets from linear TV to over-the-top (OTT) and/or connected TV (CTV) in the United States in 2023

-

Premium Statistic

Connected TV programmatic advertising household reach in the U.S. 2022-2023

Connected TV programmatic advertising household reach in the U.S. 2022-2023

Share of internet-connected households reachable via connected TV (CTV) programmatic advertising in the United States from the 1st quarter 2022 to the 3rd quarter 2023

-

Premium Statistic

Leading CTV advertising challenges in the U.S. 2023

Leading CTV advertising challenges in the U.S. 2023

Leading connected TV (CTV) advertising challenges according to marketers in the United States as of August 2023

-

Premium Statistic

Top obstacles preventing CTV ad spending in the U.S. 2023

Top obstacles preventing CTV ad spending in the U.S. 2023

Leading obstacles preventing spending on connected TV (CTV) advertising in the United States as of March 2023

Digital out-of-home

10

- Premium Statistic Share of U.S. marketers including or intending to add prDOOH to media plans 2024

- Premium Statistic Top methods for purchasing DOOH campaigns according to marketers in the U.S. 2024

- Premium Statistic Share of programmatic OOH spending in the U.S. H1 2024, by transaction category

- Premium Statistic Distribution of programmatic OOH spending in the U.S. H1 2024, by advertiser category

- Premium Statistic Distribution of programmatic OOH spending in the U.S. H1 2024, by asset category

- Premium Statistic Top sources for marketers' planned increase in prDOOH ad spending in the U.S. 2024

- Premium Statistic Attributes of OOH, DOOH, and prDOOH ads according to marketers in the U.S. 2024

- Premium Statistic Distribution of prDOOH campaigns in the U.S. 2023, by target market

- Premium Statistic Top ways to measure prDOOH ads' attribution according to marketers in the U.S. 2024

- Premium Statistic Top elements that would help marketers learn more about prDOOH ads in the U.S. 2024

Digital out-of-home

-

Premium Statistic

Share of U.S. marketers including or intending to add prDOOH to media plans 2024

Share of U.S. marketers including or intending to add prDOOH to media plans 2024

Percentage of marketers who have included or intended to include programmatic digital out-of-home (prDOOH) advertising in their media plans in the United States as of August 2024

-

Premium Statistic

Top methods for purchasing DOOH campaigns according to marketers in the U.S. 2024

Top methods for purchasing DOOH campaigns according to marketers in the U.S. 2024

Leading methods for purchasing digital out-of-home (DOOH) campaigns according to marketers in the United States as of August 2024

-

Premium Statistic

Share of programmatic OOH spending in the U.S. H1 2024, by transaction category

Share of programmatic OOH spending in the U.S. H1 2024, by transaction category

Distribution of programmatic out-of-home (OOH) spending in the United States in 1st half 2024, by transaction type

-

Premium Statistic

Distribution of programmatic OOH spending in the U.S. H1 2024, by advertiser category

Distribution of programmatic OOH spending in the U.S. H1 2024, by advertiser category

Distribution of programmatic out-of-home (OOH) spending in the United States in 1st half 2024, by advertiser category

-

Premium Statistic

Distribution of programmatic OOH spending in the U.S. H1 2024, by asset category

Distribution of programmatic OOH spending in the U.S. H1 2024, by asset category

Distribution of programmatic out-of-home (OOH) spending in the United States in 1st half 2024

-

Premium Statistic

Top sources for marketers' planned increase in prDOOH ad spending in the U.S. 2024

Top sources for marketers' planned increase in prDOOH ad spending in the U.S. 2024

Leading sources for a planned increase in programmatic digital out-of-home (prDOOH) advertising spending according to marketers in the United States as of August 2024

-

Premium Statistic

Attributes of OOH, DOOH, and prDOOH ads according to marketers in the U.S. 2024

Attributes of OOH, DOOH, and prDOOH ads according to marketers in the U.S. 2024

Attributes of out-of-home (OOH), digital out-of-home (DOOH), and programmatic digital out-of-home (prDOOH) advertising according to marketers in the United States as of August 2024

-

Premium Statistic

Distribution of prDOOH campaigns in the U.S. 2023, by target market

Distribution of prDOOH campaigns in the U.S. 2023, by target market

Distribution of programmatic digital out-of-home (prDOOH) advertising campaigns according to marketers in the United States as of September 2023, by target market

-

Premium Statistic

Top ways to measure prDOOH ads' attribution according to marketers in the U.S. 2024

Top ways to measure prDOOH ads' attribution according to marketers in the U.S. 2024

Leading ways to measure programmatic digital out-of-home (prDOOH) advertising attribution according to marketers in the United States as of August 2024

-

Premium Statistic

Top elements that would help marketers learn more about prDOOH ads in the U.S. 2024

Top elements that would help marketers learn more about prDOOH ads in the U.S. 2024

Leading elements that would help marketers learn more about programmatic digital out-of-home (prDOOH) advertising according to professionals in the United States as of August 2024

Marketer insights

8

- Premium Statistic Frequency of serving wrong creative to wrong consumer in the U.S. 2023

- Premium Statistic Media developing the most innovative opportunities for advertisers in the U.S. 2022

- Premium Statistic Most popular B2C marketing direct response channels in the U.S. 2021

- Premium Statistic Types of 3rd party data used in digital ad campaigns in North America 2022

- Premium Statistic Factors influencing the choice of 3rd-party data provider in North America 2022

- Premium Statistic Challenges advertisers faced when reaching target audiences in the U.S. 2022

- Premium Statistic Change in contextual data use among U.S. marketers 2023

- Premium Statistic Importance of AI use in programmatic advertising in the U.S. 2023, by stakeholder

Marketer insights

-

Premium Statistic

Frequency of serving wrong creative to wrong consumer in the U.S. 2023

Frequency of serving wrong creative to wrong consumer in the U.S. 2023

Frequency of serving wrong digital creative to wrong consumer according to marketers in the United States as of October 2023

-

Premium Statistic

Media developing the most innovative opportunities for advertisers in the U.S. 2022

Media developing the most innovative opportunities for advertisers in the U.S. 2022

Media developing the most innovative opportunities for advertisers according to agency and ad executives in the United States as of June 2022

-

Premium Statistic

Most popular B2C marketing direct response channels in the U.S. 2021

Most popular B2C marketing direct response channels in the U.S. 2021

Most popular B2C marketing direct response channels according to marketers in the United States as of November 2021

-

Premium Statistic

Types of 3rd party data used in digital ad campaigns in North America 2022

Types of 3rd party data used in digital ad campaigns in North America 2022

Types of third-party data in digital advertising campaigns in North America as of December 2022

-

Premium Statistic

Factors influencing the choice of 3rd-party data provider in North America 2022

Factors influencing the choice of 3rd-party data provider in North America 2022

Factors influencing the choice of a third-party data provider in digital advertising in North America as of December 2022

-

Premium Statistic

Challenges advertisers faced when reaching target audiences in the U.S. 2022

Challenges advertisers faced when reaching target audiences in the U.S. 2022

Challenges advertisers faced when reaching target audiences according to marketers in the United States as of September 2022

-

Premium Statistic

Change in contextual data use among U.S. marketers 2023

Change in contextual data use among U.S. marketers 2023

Change in contextual data use among marketers in the United States in 2023

-

Premium Statistic

Importance of AI use in programmatic advertising in the U.S. 2023, by stakeholder

Importance of AI use in programmatic advertising in the U.S. 2023, by stakeholder

Importance of the use of artificial intelligence (AI) in programmatic advertising in the United States as of November 2023, by stakeholder

Further reports

Get the best reports to understand your industry

Contact

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)